How much can you typically borrow for a mortgage

340600 x 60. How much do you have for your deposit.

Hh Z1ipq2apxym

Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily.

. You could borrow up to. This mortgage calculator will show how much you can afford. Ad More Veterans Than Ever are Buying with 0 Down.

Proceeds Year 1 Principal Limit x 60. Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Get Started Now With Quicken Loans.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. Basically the higher the deposit you can pay the better your mortgage deal a lower interest rate and lower. Find out more about the fees you may need to pay.

I f youre thinking about taking advantage of todays best refinance rates on your mortgage refi you might wonder how much you can borrow on your new home loan. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Ad Home Ownership Can Be Rewarding.

If you are in this category you. The solution below shows how much money he can get in year one. Unlike other types of FHA loans the maximum.

If you can afford to no. Ad Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. There are many mortgage options with low or no down payment requirements.

Looking For A Mortgage. Should I take the full amount I can borrow. Most buy-to-let mortgages are interest-only.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. See If You Qualify for Lower Interest Rates. Percentage of Gross Monthly Income.

Some lenders have a minimum of 100000 income. Ad More Veterans Than Ever are Buying with 0 Down. Check Eligibility for No Down Payment.

For example if your income is 300000 all reputable mortgage. CAD 500 Summary Monthly mortgage payment CAD 160000 You can borrow up to CAD 31743990 Book an appointment Start pre-approval. Higher income depending on the lender you would need a minimum income of 60000.

The first step in buying a house is determining your budget. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Fill in the entry fields and click on the View Report button to see a.

Theres also the option for a construction mortgage. You typically need a minimum deposit of 5 to get a mortgage. Check Eligibility for No Down Payment.

First Discover Each Step Of The Home Buying Process. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. This mortgage calculator will show how much you can afford.

Its A Match Made In Heaven. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. If youre taking out a mortgage with.

7 rows Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be. Theres a general perception that you have to put 20 down to get a mortgage. Its an important point to bear in mind as youll need to be able to pay back the.

How much can you afford to borrow for a home. You should expect to borrow 60-75 of the value of the property. Principal Limit MCA x PLF.

Ad Compare Mortgage Options Get Quotes. Your salary will have a big impact on the amount you can borrow for a mortgage. If you have a healthy and steady cash flow you can expect the amount to be twice as much as your income.

650000 x 524. Typically you can borrow up to 45 times your income for a mortgage. Here Are Some of The Common Ways That Mortgage Lenders Determine How Much You Can Borrow.

But this will vary depending on the lender and the type of mortgage. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Were Americas 1 Online Lender.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Before you can obtain a mortgage you must undergo a qualification. Thats just not true.

Ad Check FHA Mortgage Eligibility Requirements. Trusted VA Home Loan Lender of 200000 Military Homebuyers. When it comes to residential purchases the minimum deposit requirement is 5-10 and you wont usually need to provide more than that unless the lender considers you a.

For instance some deals offer 55. You may qualify for a loan amount of 252720 and your total monthly mortgage. Ideally your monthly mortgage.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Key Terms To Know In The Homebuying Process Infographic Home Buying Process Process Infographic Home Buying

A Little Cheat Sheet To Help You When Buying A Home Call Me When You Re Ready Or Have Any Questions Remax Home Buying Things To Sell

What Type Of Mortgage Should You Get Refinance Mortgage Mortgage Loans Refinancing Mortgage

Best Rates Of Home Equity Loans At Ushud Home Equity Home Equity Loan Equity

How To Calculate Annual Percentage Rate 12 Steps With Pictures Investing Borrow Money Calculator

Mortgage Calculator How Much Can I Borrow Nerdwallet

9 Reasons To Apply For Personal Loan Personal Loans Business Loans Best Online Jobs

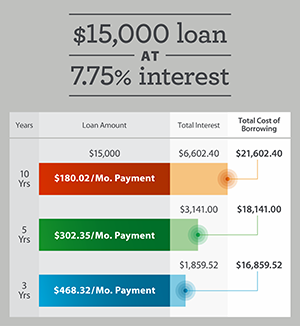

Understand The Total Cost Of Borrowing Wells Fargo

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Monthly Payments Will Cost

Mortgage Calculator How Much Can I Borrow Nerdwallet

Understand The Total Cost Of Borrowing Wells Fargo

Tips For Repaying Your Payday Loan Payday Loans Payday Best Payday Loans

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates